Introduction

Indian economy has since long understood that the corporate sector alone is not the backbone of the country’s financial stability. The micro, small and medium sector is of equal importance and can lift the economy to new heights. The Government of India therefore has a separate ministry that governs and looks after the needs and progress of the MSME sector. The Government, Banking sector as well as Non-Banking Financial sector have all understood the importance of the MSME Sector (Micro, Small and Medium Sector) and have come out with many special aides and loan packages suitable or tailor made for their needs. The MSME loans are designed to be such to achieve maximum reach and provide financial assistance to the majority of the MSME units.

Definition of MSME Sector

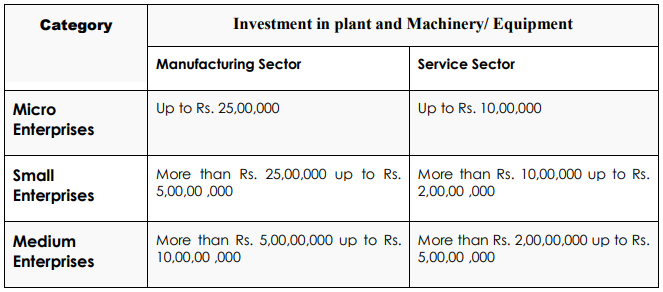

The Government of India has defined the Micro, Small and Medium enterprises under the Micro, Small and Medium enterprises Development Act (MSMED), 2006. The Act classifies the MSME units under two categories or classes namely those engaged in manufacturing activities and those engaged in service activities. The Act has specified the amount of investment to be made by such units in the plant or machinery or equipments for both the manufacturing units as well as service units in order to be classified as MSME entities. These limits are specified hereunder.

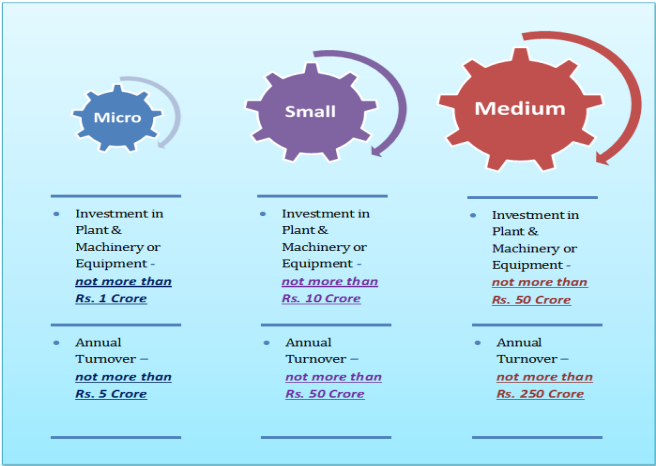

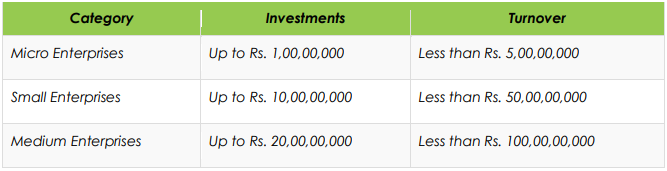

The Finance Ministry has recently revised the above limits that essentially change the definition of the MSME sector. The revised limits are specified hereunder

The above limits are the same for manufacturing as well as service sector which means that there is no further classification based on activities as was the case earlier

Purpose of MSME Loans

As is the case with any loan product, MSME loans are essentially a tool to provide financial assistance to the MSME units and thereby safeguard their stability and future. These loans can be procured for a variety of reasons depending on the needs of the entity. Some of the needs or purposes for loans towards MSME units include,

Types of MSME Loans

NBFCs and Banks both offer many types of loan products to the MSME sector or MSME units engaged in manufacturing, trading or service operations. These loan products depend on various factors apart from the organization’s needs like the tenure of the loan, rate of interest, collateral requirement, urgency of the funds, etc. the various types of loan products offered to the MSME sector are,

Eligibility for MSME Loans

The entities that fall under the definition of the MSME as per the MSMED Act, 2006 are eligible for the various loan products offered by the government or banks or other financial institutions. These eligible entities include individuals (professionals/selfemployed), sole proprietorship, partnership firms, limited liability companies, private limited companies, trusts or societies. Some lenders lay down specific exclusions for a certain category or class of entities from their eligibility criteria (for example: Lendingkart specifically excludes trusts and NGOs and charitable institutions)

MSME loans are particularly supportive or beneficial for start-ups that fall under this category as they can get easy access to the necessary funds without any hassles or unnecessary delays.

However, listed below are the general criteria you will have to meet:

Documentation for MSME Loans

The documentation process for MSME loans is generally very simple and basic in case of all lenders (Banking or Non-Banking). This enables the MSMEs to get prompt loans for their financial needs without the heavy burden of documentation

The list of documents to be submitted for an MSME loan usually comprises of the following

1. KYC (Pan Card, Aadhar Card)

2. Business Address Proof : Trade License/Lease Agreement/Sales Tax Certificate

3. Utility Bill under the name of the business – Telephone or Electricity bill, not more than 3 months old

4. Proof of Age of the Applicant(s): even though it may be a business, the partners, individuals or directors involved in the business need to submit their proof of age as one of the documents required for MSME Loans.

5. Business Plan; this would be necessary to ascertain your business, the industry and the long term growth prospects before the loan is sanctioned.

6. Bank Statement: Bank account statement under the name of the company of the last 6 months.

7. Income Proof: ITR with the profit and loss account and balance sheet.

8. Registration Proof: A vital documentation required for MSME Loans is proof of registration that could be: Partnership deed

9 . Memorandum of Associations (MoA), Article of Associations (AoA)

10. Sales Deed

11. Copy of Licenses & Certificates

12. Rent agreement

13. MSME Certificate also known as Udyam Registration Certificate

This list of documents may vary from lender to lender depending upon their set guidelines. Applicants or borrowers can get all the relevant details of the documents to be submitted by contacting the lender.

Features of MSME Loans

MSME loans come with many unique features that make it an easy and viable option to raise or procure finance in order to satisfy the business needs of any organization. These loans are more flexible and affordable as compared to corporate loans as the main aim is to provide financial strength to the MSME sector and thereby eventually uplift the economy as a whole. There are many lenders of MSME loans available in the market that provide competitive loans to the business entities. These loans may vary in terms of the quantum of loans, rate of interest charged, tenure, margin requirements, etc. However, the general norm or the general features of the MSME loans available to the borrowers are discussed below

Amount of loan

The amount of loan that can be provided to a borrower basically depends on their need as compared to their repaying capacity among many other factors. Lenders can provide loans to the MSME sector for amounts ranging from Rs. 50,000 to crores depending on their guidelines. Some lenders restrict the amount of lending by putting an upper limit on the maximum amount of loan that can be sanctioned or a similar criterion depending on the borrower’s earnings or repayment capacity. Many other lenders do not have any upper limit on the amount to be sanctioned as loan. The loan amount in such case will be need based.

Rate of Interest

The rate of interest on the MSME loans depends on many factors like

The rate of interest on MSME loans are designed as such to not burden the borrower with huge interest payments as well as provide timely access to the funds where the borrowers are not discouraged to borrow funds on account of heavy interest outflows. The interest rate in this category of loans are based on the Marginal Cost of fund based Lending Rates (MCLR) from 1st April, 2016 as per RBI guidelines. The loans that have been provided based on Base rate or BPLR can continue till maturity but the lender has to provide the option to the borrower to convert the loan to MCLR based rate of interest without treating the same as a foreclosure of the loan. Interest rates are higher for loans that are given without any collateral as compared to secured loans.

Tenure

The tenure of MSME loans start from a minimum period of 12 months (1 year). This tenure can be extended up to even 10 years or 15 years depending on the rules and regulations or guidelines of the lenders. The general norm for MSME loans is tenure of 3 years to 5 years. NBFCs usually offer a shorter tenure as compared to traditional banking options.

Collateral

MSME loans are provided to the small borrowers with the purpose or aim to empower them so that they can advance their business organization and further strengthen the economy as a whole. These loans are usually collateral free mostly in case of NBFC lenders. Some banking institutions may require collateral to be provided for the amount equal to the loan amount or as specified under their guidelines. Collateral free loans have a higher interest rate as compared to the loans that require collateral.

Processing charges

Many banks and NBFCs provide loans to the MSME units at nominal processing charges. These processing charges are charged as a percentage of the loan amount. Some lenders have also laid down a minimum and maximum amount limit that can be charged as processing charges from the borrowers.

Other features

Some lenders also have set margin requirements that the borrowers have to meet in order to secure a loan. Whereas in some cases, lenders provide 100% of the finance needed by the MSME units. Borrowers have to check the guidelines or rules of specific lenders regarding the same.

Many lenders provide easy prompt and unsecured loans to the MSME sector. Such loans enable the borrowers to have immediate access to the funds to take care of their urgent or impending dues.

MSME loans are also subject to many other charges like penalty charge on delay or non-payment of dues, foreclosure or part closure charges, documentation charges, cheque bounce charges, etc. these charges vary from lender to lender according to their set policies. Borrowers must have a thorough knowledge of all such charges (whether hidden or not) before applying for a loan.

Government Schemes Associated with MSME sector

The Government of India has launched many schemes over the years to provide financial assistance to the MSME sector. These loan schemes provide easy and collateral free (in some cases) immediate financial support to the MSME units for employment generation as well as business prosperity. Some of such schemes are mentioned below.

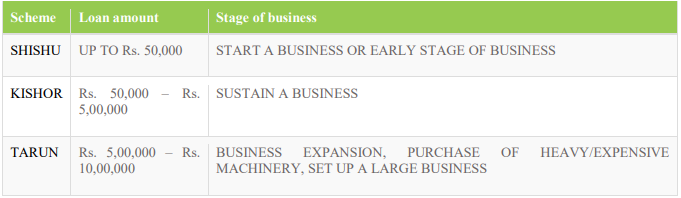

MUDRA loans

MUDRA loans are the loans provided to the MSME sector under the Pradhan Mantri Mudra Yojana (PMMY). These loans are provided up to a maximum of Rs. 10,00,000 to non-corporate non-farming small and micro entities or enterprises. Loans are classified under three schemes as per PMMY depending on the stage of the business (growth or development). Loan amount to be disbursed depends on this classification

CGTMSE (Credit Guarantee Trust Fund for Micro & Small Enterprises)

Another similar scheme launched by the government is Credit Guarantee Funds Trust for Medium and Small Enterprises. The loans provided under this scheme are collateral free and the eligible applicants are the new as well as existing Micro and Small enterprises. The maximum amount of loan sanctioned under this scheme is Rs. 1,00,00,000.